Here are some notes I took from the book “Complete Encyclopedia for Covered Call Writing” by Alan Ellman. I’m already familiar with how options work, so these notes only cover the new concepts I learned. I strongly recommend that you buy the book (it’s a good book) for more details and information.

Chapter 9 – Executing a Covered Call Trade

Two Types of Orders

Legging in

The stock is first purchased with a market (if stock is heavily traded with a small bid-ask spread) or limit order. Once this trade is executed, the call option is then sold (generally) with a limit order. Select the limit order as a Day order and do not check the “All or None” box.

Buy-Write (Net Debit) Order

Some brokerage films offer buy-write orders, which is a net-debit order (i.e. we need to pay “stock price – option price + fees” to open this trade). Select the order as a limit and day order.

A day order is the best duration for covered call writers. If our order is not filled the day it is placed, option premium may have changed and our calculations will need to be re-evaluated.

Playing the Bid-Ask Spread

Only the highest bid and lowest ask are used to calculate the bid-ask spread.

The Show or Fill Rule requires market makers to show or publish any order that improves the current bid or ask prices unless it is filled. However, if the “All Or None” box is checked, he no longer has this obligation. Most exchanges have a policy in place that requires market makers to fill AT LEAST 10 contracts at the quoted (published) price.

As long as the bid-ask spread isn’t too tight or close together, we place our order between the two quoted prices (just slightly below the midpoint of the bid-ask spread). If the market maker (MM) does not fill the order, he will be required to publish it and then be obligated to fill at least 10 contracts, perhaps more, at that price.

To take advantage of the show or fill rule we must:

- Improve the market (bid-ask spread)

- Sell 10 contracts or less

- Not check the all or none box on the trade execution form

Should we use a Stop-Loss order?

The author is against it.

If we simply sell the stock, we’ll have a naked call option position which is very risky. If we have a stop-loss order on the option, it is difficult to determine in advance what the stock price is when we close the option position.

Finally, we may lose the opportunity to generate additional income if we use a stop-loss. Great performing stocks will sometimes consolidate. If the stock is still trading above its moving average and no negative news has come out, why not buy back the option and look to resell the same option when the stock recovers. Hastily selling a stock without properly evaluating chart technicals, market tone and current news will cost us money. Stop-losses cannot do this analysis for us.

If you go on vacation, you can bring your laptop along to monitor your positions. Alternatively, you can close your positions before you leave (or don’t enter them in the first place).

Protective Puts / The Collar Strategy

The risk for selling covered call options is in purchasing the stock. Therefore, some investors also buy puts to alleviate some of the risk.

In a true collar strategy, the puts and calls are both out-of-the-money and have the same expiration dates and an equal number of contracts.

The author does not feel that the additional cost for the puts is worth it, as long as you do your due diligence when selecting the stocks and option strike prices (based on the BCI system).

Chapter 10 – Exit Strategies

Definition of Terms:

Convert Dead Money to Cash Profits:

Buy back an option and sell the stock. Use cash generated to buy a better performing stock and sell another covered call.

Hit a Double:

Buy back an option and resell at a higher premium in the same contract period.

Hit a Triple:

Buy back an option twice and resell twice in the same contract period.

Exit Strategies

| Zone | Steps |

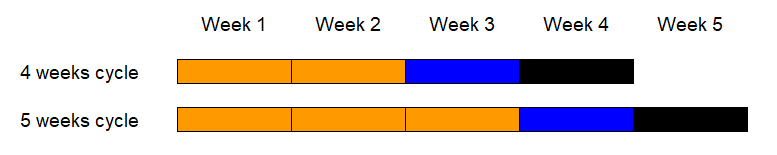

| Orange | If stock appreciates a lot You can do a mid-contract unwind (i.e. sell stock and buy back option) if time value of option is near zero. If stock dips Buy back the option when its value <= 0.2*original premium. Can attempt to hit a double early in this zone if market tone and stock technicals are mixed to positive. If market tone and stock technicals are mixed to negative (esp. if it is late in this zone), can do a roll down. |

| Blue | Buy back the option when its value <= 0.1*original premium. |

| Black | If option is ITM You can: – roll out if you are uncertain about share appreciation, or – roll out and up if there is a good chance for share appreciation, or – do nothing if you do not want to keep the stock If option is OTM If you want to keep the stock, do nothing. |

If at any time during the contract cycle, you believe that a stock could be in serious danger of dropping dramatically in price, buy back the option at any price , sell the stock, and immediately move the cash into another position. Guidelines for selling stock include:

- When the stock is significantly under-performing the S&P 500.

- Unexpected, concerning negative news comes out during the current contract.

- The share price declines > 7% from when the trade was initiated.

Factors to consider Prior to Expiration Friday (Orange and Blue Zones)

- Price of stock: If share price appreciates to the point where the option premium has no time value, we can unwind our position at very little or no cost.

- Market tone: About 70+% of a stock move is due to the general market trend. A strong chart pattern for the S&P 500, coupled with a declining or sideways trading pattern for the VIX at a low volatility level is viewed as bullish by stock traders.

- Technical Analysis of stock: If all indicators of the underlying stock have turned negative from the initial purchase of the stock, consider buying back the option and selling the stock immediately. If the chart gives mixed signals, be more conservative.

If option satisfies the 20%/10% rule

Take no action and attempt to hit a double or triple

(early and positive market tone)

BTC the option and watch the stock price without taking additional immediate action. If the stock appreciate in value in a relatively short period of time after the initial buy-back of the option, sell the exact same option (same strike and expiration date) again.

We attempt to “hit a double” when the market tone and stock technicals are mixed to positive earlier in the contract period (especially during the first week or early in the second). If the stock does not appreciate late in the orange zone, we can then use the rolling down strategy below.

Example: BCSI

26 Oct: BTO stock @ $25.35

26 Oct: STO $25 Call @ $1.35

30 Oct: BTC $25 Call @ $0.25

5 Nov: STO $25 Call @ $1.15

Roll Down

(late and negative market tone)

BTC a previously sold option and sell another option at a lower strike price in the same contract month.

Use this strategy when the market tone and technicals are mixed to negative. Also, it is advisable to use this strategy later (rather than earlier) in the orange zone.

Example: HAS

29 Oct: BTO stock @ $28.50

29 Oct: STO $30 Call @ $1.5

11 Nov: BTC $30 Call @ $0.15

11 Nov: STO $25 Call @ $2

On Day of Expiration

Stock closed just below $25 and shares are not assigned and not sold. There is a paper loss of $350 on the stock and an option profit of $(1.5 – 0.15 + 2)*100 = $335.

If stock appreciates a lot

When a strike moves deep ITM, the time value of that option premium declines and approaches zero.

Mid-Contract Unwind

We can consider buying back the option and selling the stock if the time value of the option premium is close to zero (cost of unwinding position = time value) and there is enough time remaining (two weeks or more) in the current contract cycle to generate additional profit with another position.

Alternatively, we can consider rolling up. However, the price of the stock may not be in a favourable position to generate a decent return. In addition, given the drastic share appreciation over a short period of time, the possibility exists that profit-takers (sellers) could cause the price to decline drastically.

Example: PRGO -> BUCY

22 Mar: BTO stock @ $51.10 (Week 1)

22 Mar: STO $50 Call @ $2.1

29 Mar: BTC $50 Call @ $6.9 (IV = 6.79, TV = 0.11)

29 Mar: STC stock @ $56.79

If we do not close the PRGO position, the profit is $(50 – 51.10 + 2.1)*100 = $100. If we close the position, the profit is $(56.79 – 51.1 + 2.1 – 6.9)*100 = $89.

Cost of closing PRGO position = Current time value of option = $11.

29 Mar: BTO stock @ $67.48

29 Mar: STO $65 Call @ $3.9

Profits = $(65 – 67.48 + 3.9)*100 = $142

ROO = (3.9 – 2.48) / 65 = 2.2%

Additional Profits = $142 – $11 = $131

If stock underperforms

BTC the option at any price, sell the poor-performing underlying equity, purchase a new, healthier stock and proceed to sell the option on that stock.

There is an opportunity cost with keeping an underperforming stock. We utilize this strategy when the stock technicals are negative and the stock price has dropped with little sign of near-term improvement. This choice can be utilized at any time during the contract period prior to expiration Friday.

If stock gaps down

Determine what caused the equity to gap down. If it is a serious matter that alters the prospects for that company, you should consider selling the stock. Else, you can keep the stock if it is not underperforming the market.

Serious: Corporate fraud, the departure of a key officer of the company, the loss of a patent, an announcement that the FDA has rejected a company’s new drug, new legislation, etc.

Not serious: A single analyst downgrade.

If you decide to keep the stock

First, we need to buy back the option. If we are mid-contract or earlier, we can wait for a bounce back and attempt to “hit a double”. If the stock is slow to recover its value, we can roll down to a lower strike price that is still OTM.

If you decide to sell the stock

Buy back the option and sell the stock

Factors to Consider On or Near Expiration Friday (Black Zone)

- Current Stock Price: We consider an exit strategy near expiration only if the current stock price has exceeded the strike price (i.e. the option we sold is ITM). We can either roll out or roll out and up.

- Market Tone and Stock Technicals: A strongly positive or sometimes mixed market tone with concurrent positive stock technicals will encourage a higher strike price (i.e. roll out and up). A mixed marker tone with concurrent mixed stock technicals or negative market tone may direct us to a lower strike price (i.e. roll out).

- Earnings Report: If the equity will be reporting in the upcoming contract period, we have three choices.

– Allow assignment and use the cash to purchase a different equity the following week

– Buy back the option and own the stock through the earnings report without selling an option

– If earnings is reported early in the next contract period, allow the shares to be sold and buy back a day or two after the report if all system criteria are still in place.

If you are uncertain about share appreciation

If option is ITM and market tone and/or stock technicals are mixed to positive, but you are uncertain about share appreciation, you can roll your option out (as long as you still love the stock and the returns it generates). This involves buying back the current contract month option and selling an option with the same strike price for the next contract month.

Example: DLTR

BTO stock @ $34.25

STO $35 Call

BTC $35 Call @ $0.6 (Stock @ $35.28)

STO $35 Next Month Call @ $3.20

ROO = (3.2 – 0.6) / 35 = 7.4%

If you allow assignment and BTO stock and STO option for the next contract cycle, you may not get the same ROO. If the deal is there, take it.

If you believe shares will continue to appreciate

You can roll out and up. The new, higher strike can be ATM, ITM or OTM.

Example (roll up to OTM option): CPO

BTO stock @ $23

STO $22.50 Call

BTC $22.50 Call @ $2.45 (Stock @ $24.58)

STO $25 Next Month Call @ $2.10

ROO = (2.1 – 2.45 + 24.58 – 22.5) / 22.5 = 7.7%

Example (roll up to ITM option): DV

BTO stock @ $47.5

STO $45 Call

BTC $45 Call @ $7.30 (Stock @ $52.02)

STO $50 Next Month Call @ $4.20

ROO = (4.2 – 7.3 + 5) / 45 = 4.2%

Downside Protection = 2.02 / 52.02 = 3.9%

If you decide that it is best to allow assignment

If there is an upcoming earnings report, or technical indicators suggest that you should sell the stock, or your calculations indicate that the cash in that stock is better utilized elsewhere, you can do nothing and allow assignment.

Share assignment will occur over the weekend, after 4PM, on expiration Friday, and the cash from that sale will be in our account by the following Monday. This will cost us one commission (the sale of the stock) rather than two (close short option position and then sell the stock).

Why does early assignment occur?

- When the option is deep ITM, the chance of early assignment increases. This is because it is possible that the bid price of the option is lower than the intrinsic value. Institutional investors can often get pricing closer to the bid and take advantage of this situation. If the option has a high open interest, it is a sign that institutional players are involved.

- If the dividend value is greater than the time value remaining for an option, early assignment may also occur.

Chapter 17 – Selling Naked or Cash-Secured Puts vs. Covered call Writing

Advantages of Covered Call Writing

- The covered call seller captures all the dividends distributed by the underlying corporation

- Selling covered calls allows the seller to benefit from share appreciation, if he sells an OTM option

- If stock gaps down, the put seller may be assigned. But he is unable to sell the stock until the assigned shares hit his account, and may have to wait till the next day to do so (while the stock keeps plummeting).

Leave a Reply