Ticker: MU

| Date | Trade | Quantity | Entry | Stop Loss | Exit | Percentage Profit | Remarks | Days To Exit |

| 12 Mar 10 | Buy | 1 | 10.01 | 9.32 | 9.8 | -30.43% | 7 | |

| 27 Aug 10 | Sell | 1 | 6.72 | 7.45 | 6.95 | -31.51% | 6 | |

| 29 Sep 10 | Buy | 1 | 7.28 | 6.59 | 7.01 | -39.13% | Stop loss was based on a recent low | 4 |

| 11 Oct 10 | Buy | 1 | 7.69 | 6.76 | 7.93 | 25.81% | Stop loss was based on a recent low | 22 |

| 2 Dec 10 | Buy | 1 | 7.9 | 7.09 | 8 | 12.35% | 16 | |

| 13 Jan 11 | Buy | 1 | 9.79 | 8.36 | 11.45 | 116.08% | Entry after a gap up | 27 |

| 21 Apr 11 | Buy | 1 | 11.46 | 10.3 | 11.25 | -18.10% | 6 | |

| 19 Aug 11 | Sell | 1 | 5.55 | 6.48 | 5.96 | -44.09% | 7 | |

| 29 Sep 11 | Sell | 1 | 6.05 | 6.77 | 5.21 | 116.67% | 8 | |

| 19 Oct 11 | Buy | 1 | 5.85 | 5.1 | 5.37 | -64.00% | 6 | |

| 17 Nov 11 | Buy | 1 | 6.89 | 5.06 | 5.56 | -72.68% | Huge breakout bar, +23% | 13 |

| 4 Jan 12 | Buy | 1 | 7.01 | 6.06 | 7.68 | 70.53% | 16 | |

| 15 Feb 12 | Buy | 1 | 8.41 | 7.7 | 7.92 | -69.01% | 6 | |

| 28 Feb 12 | Buy | 1 | 8.84 | 7.92 | 8.31 | -57.61% | 5 | |

| 29 Jun 12 | Buy | 1 | 6.1 | 5.52 | 6.45 | 60.34% | Entry after a gap up, stop loss was based on a recent low | 6 |

| 7 Aug 12 | Buy | 1 | 6.7 | 6.01 | 6.32 | -55.07% | 12 | |

| 14 Sep 12 | Buy | 1 | 6.71 | 6.25 | 6.37 | -73.91% | 6 | |

| 2 Nov 12 | Buy | 1 | 5.85 | 5.18 | 5.63 | -32.84% | 6 | |

| 29 Nov 12 | Buy | 1 | 5.84 | 5.54 | 6.48 | 213.33% | 17 | |

| 4 Feb 13 | Buy | 1 | 7.89 | 7.54 | 7.65 | -68.57% | Stop loss was based on a recent low | 4 |

| 15 Feb 13 | Buy | 1 | 8.14 | 7.72 | 7.82 | -76.19% | 4 | |

| 28 Feb 13 | Buy | 1 | 8.28 | 7.72 | 9.05 | 137.50% | 13 | |

| 6 May 13 | Buy | 1 | 9.75 | 9.31 | 10.93 | 268.18% | 13 | |

| 24 May 13 | Buy | 1 | 11.54 | 10.57 | 13.87 | 240.21% | Stop loss was based on candle low | 27 |

| 23 Jul 13 | Buy | 1 | 13.96 | 13.36 | 13.36 | -100.00% | 2 | |

| 6 Aug 13 | Buy | 1 | 14.23 | 12.65 | 13.77 | -29.11% | 10 | |

| 30 Oct 13 | Buy | 1 | 17.55 | 16.17 | 18.9 | 97.83% | 16 | |

| 22 Nov 13 | Buy | 1 | 20.16 | 18.9 | 22.36 | 174.60% | 18 | |

| 10 Feb 14 | Buy | 1 | 24.82 | 22.65 | 24.72 | -4.61% | 9 | |

| 4 Mar 14 | Buy | 1 | 24.87 | 23.71 | 23.71 | -100.00% | Stop loss was based on recent low | 2 |

| 1 May 14 | Buy | 1 | 26.26 | 24.56 | 26.45 | 11.18% | 11 | |

| 16 Jun 14 | Buy | 1 | 31.7 | 28.47 | 31.28 | -13.00% | Signal bar was a gap up | 6 |

| 1 Jul 14 | Buy | 1 | 33.29 | 31.16 | 31.9 | -65.26% | 6 | |

| 15 Jul 14 | Buy | 1 | 33.83 | 31.9 | 32.93 | -46.63% | 5 | |

| 8 Sep 14 | Buy | 1 | 33.05 | 30.88 | 31.83 | -56.22% | Stop loss was based on a recent low | 3 |

| 18 Sep 14 | Buy | 1 | 32.37 | 29.73 | 31.35 | -38.64% | Stop loss was based on a recent low | 15 |

| 28 Oct 14 | Buy | 1 | 32.48 | 30.32 | 32.62 | 6.48% | 9 | |

| 20 Nov 14 | Buy | 1 | 33.25 | 31.69 | 34.64 | 89.10% | Stop loss was based on a recent low | 13 |

| 11 Feb 15 | Buy | 1 | 31.24 | 28.48 | 31.34 | 3.62% | Breakout bar was huge, +9.7% | 7 |

| 10 Apr 15 | Buy | 1 | 27.96 | 26.4 | 28.56 | 38.46% | 14 | |

| 28 May 15 | Buy | 1 | 28.52 | 26.34 | 27.39 | -51.83% | 5 | |

| 29 Jul 15 | Buy | 1 | 20.18 | 17.39 | 18.47 | -61.29% | 7 | |

| 22 Sep 15 | Sell | 1 | 15.31 | 16.86 | 15.59 | -18.06% | 9 | |

| 4 Nov 15 | Buy | 1 | 18.05 | 16.19 | 16.2 | -99.46% | 3 |

Results

Today’s results are quite bad, and I have no idea how to interpret them.

If I use Strategy 7 to vary the position size, starting with a $100,000 account, 5% risk per trade, I will end up with $107,518.49. The maximum drawdown is -17.64%.

If I use Strategy 8 to vary the position size, I will end up with $103,424.12. The maximum drawdown is -26.11%.

Honestly, I don’t know what to make of these results.

- Firstly, MU trended nicely from 2013 to end 2015. Hence, the results are quite unexpected when I tallied them.

- Secondly, contrary to NVDA and SWN, Strategy 8 resulted in a lower profit, with much higher drawdown.

There are a few possible reasons for MU’s poor performance:

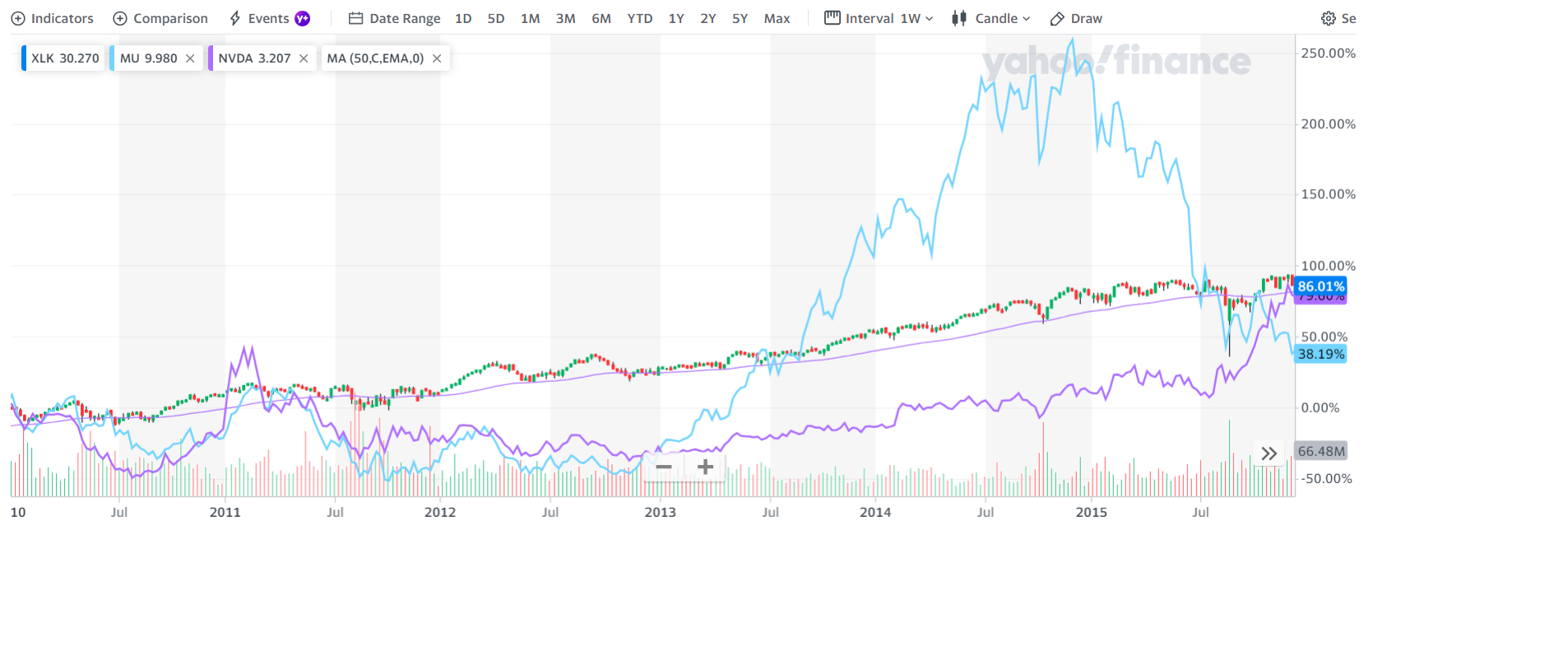

Firstly, MU does not correlate well with the sector filter. Unfortunately, for this round, I practiced using the sector filter. Hence, I do not have data on how MU will perform without the filter. However, if we refer to the chart below, we see that MU and NVDA behaved very differently in 2015.

While NVDA trended up (similar to the sector ETF, XLK), MU was on a major downtrend.

This poor correlation resulted in a few unprofitable attempts to buy when MU was in a downtrend (as the sector filter is bullish), and a few late attempts to sell MU when the sector filter finally gives a bearish signal.

In addition, I also missed a lot of bearish trades that would likely be rather profitable.

Another possible reason for the poor performance is related to a caveat I mentioned in a previous post. Previously, all the practice sessions did not use a sector filter. Let’s consider a scenario where the sector filter gave a bearish signal.

Case 1: I did not use the sector filter

As I did not use the filter, I may have entered a bullish trade. Suppose between the entry and exit of this bullish trade, a bearish setup appeared. Since I still have the bullish trade on, I would not take this bearish trade.

Case 2: I used the sector filter

If I used the sector filter, I would not have an existing bullish trade. Hence, when the bearish setup appears, I would take the trade.

Therefore, if the trade is unprofitable, not using the sector filter actually helped prevent me from taking an unprofitable trade, thus boosting the results.

In other words, simply deleting trades that are filtered out using a sector filter is not a true reflection of the strategy’s performance, as not using a sector filter also does filter out some trades (trades are filtered out when there is an existing open trade).

Going Forward

Today is the last practice session before 2024. It’s kind of frustrating to end on this negative note. Going forward, how should I proceed?

I think I’ll proceed with a sector filter as the improvement for NVDA and SWN are too significant. In addition, I’ve only tested 6 years for MU. Here’s what I’ll do:

- Complete the remaining years for MU using the sector filter.

- Repeat the practice without using a sector filter.

If I do not use a sector filter and simply delete the filtered out trades (similar to what was done for NVDA and SWN), will the results improve? If they improve, that means the discrepancy is because of the caveat mentioned above.

Side Note

On a side note, I missed a couple of forex trades too for my paper trading. I am paper trading the M15 timezone, so it is really difficult to keep monitoring price. By the time I see the setups, it was too late. Those setups look quite perfect.

Leave a Reply